Why Should ASCs Focus on Measuring Revenue Cycle KPIs?

Care delivered by Ambulatory Surgical Centers (ASC) is more cost-effective compared to Hospital Outpatient Departments (HOPD) as it saves $2.6 billion a year for Medicare. However, the reimbursement rates for ASCs have been shrinking over the last decade, posing survival challenges for providers. On average, they are reimbursed 58% less compared to a hospital for a similar procedure.

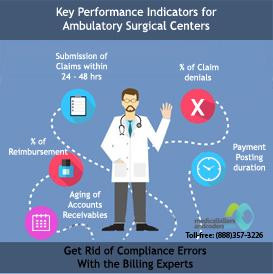

It has become important for the ASCs to identify and measure their revenue cycle key performance indicators (KPI) for ensuring financial success considering the shrinking reimbursement rate. According to industry experts, it is necessary to make sure that ASCs thrive financially because they play an essential role in providing high-quality, affordable care to patients.

Have you Measured the KPIs yet?

Is your revenue cycle being managed efficiently? Have you identified the KPIs of your revenue cycle such as net collection ratio and the AR aged above 90 days? If the answer is no, you need to start focusing on these indicators because they can tell you how your ASC is faring in financial and regulatory waters.

The identification of KPIs can impact the bottom line of ASCs. Once the practice gets to know where it stands, it can become easy to set performance goals for the future, helping providers measure the progress of their revenue cycle.

Here are some KPIs that ASCs need to measure:

1. Percentage of Reimbursement

2. Days to post Payments

3. Percentage of Denials

4. Days to Medical Billing

5. Days in AR

6. Aging over 90 days

Days in Accounts Receivables

This is the average number of days it takes for an ASC’s billing department to get paid for the rendered services. If the AR days are low, it means cash flow is regular. If AR days start increasing, it will lead to reduced cash flow.

Compliance Errors

The ASCs also need to focus on compliance errors because even a small mistake such as omission of relevant information or procedural errors can affect the smooth functioning of the practice. Regulatory errors such as billing for incorrect units, diagnoses, or charges can also prove challenging. It is recommended to have a list of compliance errors and train the staff for potential regulatory audits.

Claims Denials

ASCs need to track information related to claim denials as it will not only help providers to ensure a smooth billing procedure but also identify mistakes that are causing the denials.

No Time to Identify, Measure and Improve KPIs?

Running an ASC can be pretty challenging, with no time left for identifying and measuring the KPIs. The failure to do so might result in disruptions in cash flow and impact the bottom line of ASCs. This is the reason why many surgical centers are outsourcing their billing to companies like MedicalBillersandCoders.com. Billing vendors like MBC have a team of skilled coders and billers who are well-trained in strengthening the revenue cycle for providers. They work on all the indicators as mentioned earlier to ensure timely payments for ASCs.

To know more about Why Should ASCs Focus on Measuring Revenue Cycle KPIs?, click here: https://bit.ly/3shckmh Contact us at info@medicalbillersandcoders.com/ 888-357-3226.