12/1/2021

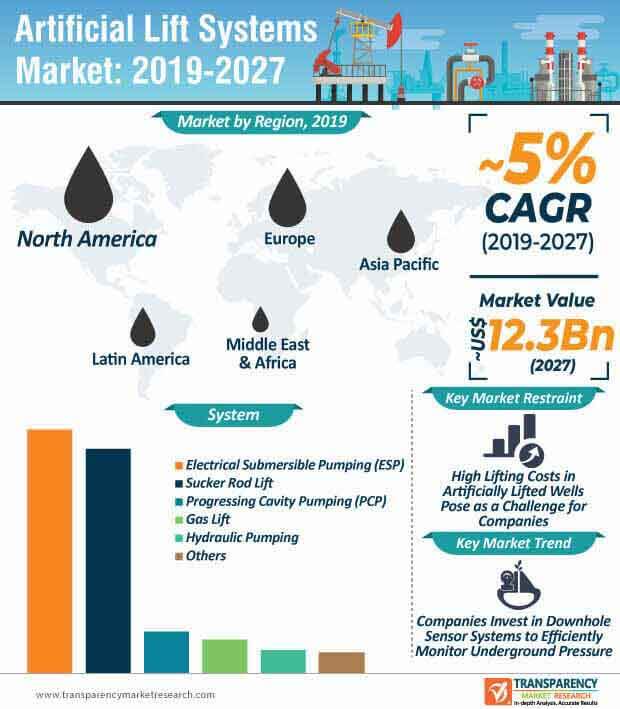

Artificial Lift Systems Market Size & Share to See Modest Growth Through 2027

5/17/2022

Business Intelligence Software Enables End Users Achieve High Productivity Levels

There is a growing need to improve digital oilfield operations in the artificial lift systems market. Fortunately, new technologies are making it possible for manufacturers to meet specific requirements of stakeholders in the oil & gas industry.

Since stakeholders in the oil & gas industry are constantly looking for options to optimize production costs, companies in the market for artificial lift systems are introducing business intelligence and analytics software. As such, software component segment of the artificial lift systems market is expected to reach a value of ~US$ 2.6 Bn by the end of 2027. Hence, companies in the market for artificial lift systems are collaborating with software engineers to develop advanced software systems.

Get Brochure of the Report @https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=1954

Stakeholders in the oil & gas industry are increasingly benefitting from advanced business-intelligence software, since such software not only offer data on virtual flowmeters (VFMs), but also provide information across all inputs in an oilfield. Such operational practices are helping stakeholders to achieve high productivity levels.

Enquiry Before Buying:https://www.transparencymarketresearch.com/sample/sample.php?flag=EB&rep_id=1954

Economic Advantages of Hybrid Pumps Generate Profits for Manufacturers

Workers in the oil & gas industry operate in high-risk environments. Hence, oil & gas companies are investing in technologically sound systems that ensure safety of workers. Likewise, end users in the market for artificial lift systems are increasingly investing in innovative sucker rod lift systems built with insert safety valves. This is evident as sucker rod lift system segment of the artificial lift systems market is anticipated to reach a value of ~US$ 5.1 Bn by 2027.

Sucker rod artificial lifts are being increasingly used to lift hydrocarbons from wells to the surface. Manufacturers in the market for artificial lift systems are increasing their production capacities to develop fail-safe designs of these artificial lifts in order to prevent uncontrolled blow out during phases of oil production. Insert safety valves are being interchangeably used with wireline surface valves. Since installation and retrieving procedures of the two valves collide, manufacturers in the artificial lift systems market are introducing novel insert rod pumps to support challenging oil production procedures. These hybrid pumps offer economic advantages to companies, since they serve as a new approach for retrofitting existing wells.

WRESP Technology Helps Overcome Barriers of Production Downtime

The artificial lift systems market is anticipated to grow at a favorable rate during the forecast period. However, certain hurdles act as barriers for manufacturers. For instance, the artificial lift systems market is consolidated with five major players accounting for a market share of ~65%. This poses as a hurdle for emerging players to compete with leading players in the artificial lift systems market, since the former lacks resources and capital to meet needs of end-users.

On the other hand, there is a growing need to improve operational costs involving the electric submersible pumping (ESP) technology. Undesired impact from ESP and production downtime act as major barrier affecting productivity levels of workers in the oil & gas industry. Hence, companies in the market for artificial lift systems are introducing the innovative wireline rigless retrievable electric submersible pumping (WRESP) technology to overcome the limitations of the conventional ESP technology. End-use industries are increasingly benefitting from the WRESP technology since it extends the economic life of assets.

Other articles and publications:

Guanabana Market Size & Share to See Modest Growth Through 2027

Thermoplastic Polyurethane (TPU) Market Size & Share to See Modest Growth Through 2027

5/3/2022

Battery Recycling Market Size & Share to See Modest Growth Through 2031

5/2/2022

Digital Oilfield Market Size & Share to See Modest Growth Through 2026

11/9/2021

Dodecanedioic Acid Market Size & Share to See Modest Growth Through 2031

5/20/2022

Ethylbutyrate Market Size Estimated to Observe Significant Growth by 2027

10/20/2021

Articles and publications of other companies:

5 Tips for Creating a Mobile-Friendly Ecommerce Website

8/1/2021

You can forget about waiting on queues to purchase what you've managed to get. Buying clothes online is simple and saves a large amount of time friend of yours who's far from the area of yours.

3/9/2021

Business details

- +1 (518) 618-1030

- State Tower, 90 State Street, Suite 700, Albany NY - 12207, United States

We are the ‘difference’ between success and failure in business. It can’t get simpler than this in explaining what we are. A market research company, our reports and expertise into and outside your bu