Oil & Gas Analytics Market : Competitive Strategies, Regional Analysis Forecast 2030

Uncertainty for M&A Deals amidst COVID-19 Outbreak Fuels Demand for Predictive Analysis

Machine Learning (ML) and Artificial Intelligence (AI) are known for predictive analysis. Hence, companies in the oil & gas analytics market should develop platforms using ML and AI to ease uncertainty pertaining to oil & gas mergers and acquisitions amidst the ongoing coronavirus (COVID-19) era. The pandemic has caused uncertainty for planned mergers & acquisitions (M&A) in the oil & gas sector, as the virus has caused disruptions in the supply and demand across critical industries.

The oil & gas industry has been plagued with oversupply and declining prices due to the ongoing price war between Saudi Arabia and Russia, thus causing a dilemma for planned M&A agreements. Several hundred M&A deals are at stake due to the COVID-19 pandemic. Hence, companies in the oil & gas analytics market should capitalize on this opportunity to develop software that enable stabilization of supply and demand ratio in the oil & gas industry.

Request A Sample-https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=11747

IoT-enabled Connected Devices Exhibit Data Transformation in Oil & Gas Analytics

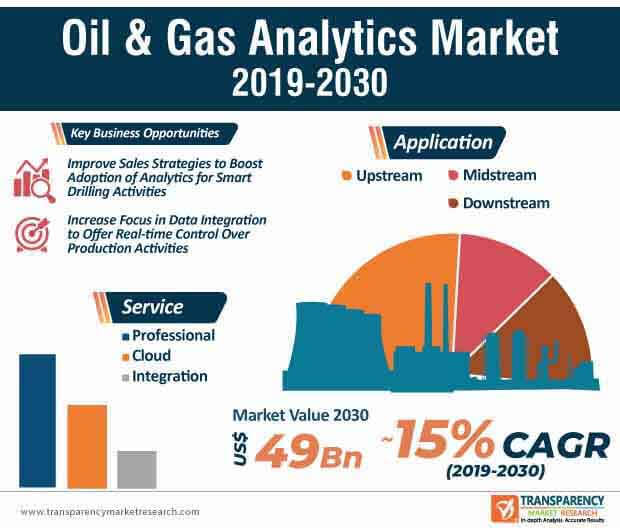

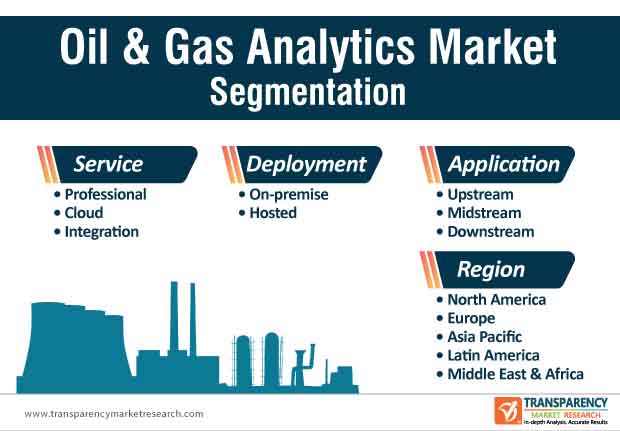

The oil & gas analytics market is anticipated to surpass US$ 49 Bn by the end of 2030. Despite having vast data sources, end-users lack the right tools and expertise to track various data points of oil & gas analytics. Hence, companies are upgrading IT (Information Technology) platforms so that end users can seamlessly track the data points of oil & gas analytics.

Bizmetric-a technologically driven company exhibiting data transformation is helping its oil & gas clients deploy IoT (Internet of Things)-driven applications in today’s digitized era. The involvement of connected devices is one of the key factors for the deployment of IoT in oil & gas analytics. Sensor-enabled devices deliver accurate information in data prediction.Purchase A Report-

REQUEST FOR COVID19 IMPACT ANALYSIS –https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=11747

AI-based Platforms Predict Operational Failures Hampering Production Activities

Artificial intelligence is revolutionizing the oil & gas analytics market. However, capitalizing on the data can be potentially challenging for stakeholders in the oil & gas industry. Hence, companies are introducing AI-based solutions to automate end-to-end processes of the upstream sector. Oil & gas analytics is being highly publicized to accelerate the pace of production and ensures site development. Favorable market drivers contribute toward a striking CAGR of ~15% for the oil & gas analytics market during the assessment period.

Production analytics for the energy industry has helped to optimize operational efficiency, where oil & gas companies can gain a competitive edge over other market players. Since multiple operations run parallel in the energy industry, oil & gas analytics have become crucial for stakeholders to predict any occurrences or failures that might hamper production activities.

Companies Enhance Marketing Strategies to Bolster Adoption of Analytics Platforms

Digital technologies in the oil & gas industry have interconnected devices that benefit stakeholders in the value chain. Likewise, oil & gas analytics has established predictive maintenance and smart drilling activities that result in cost and time efficiency. Smart oilfields are driving profitability for oil & gas organizations. However, the pace of oil & gas analytics adoption is relatively slow, which poses as a hurdle for market growth. Hence, companies in the oil & gas analytics market are bringing significant changes in their marketing, sale, and service strategies to increase the pace of analytics adoption.

Analytics startups in the oil & gas analytics market are increasing their focus in oil exploration for clients. Careful analysis of geological data to choose the best drilling locations has become increasingly important for oil & gas organizations. Oil & gas analytics are now capable of providing intelligent and real-time management of gas hydrates.

Purchase A Report-https://www.transparencymarketresearch.com/checkout.php?rep_id=11747<ype=S

Cloud-based Analytics Tools Empower Users with Enhanced Field Productivity

Digital tools such as robotics, predictive maintenance, and connected work technologies are becoming increasingly mainstream in the oil & gas industry. These trends are fueling the adoption of cloud-based analytics tools in order to achieve cost savings. Hence, companies in the oil & gas analytics market are increasing their R&D activities to innovate in cloud-enabled platforms to meet end-user demands. As such, the success of cloud-based tools relies on the usage of specialized sensors that capture real-time information from physical assets, thus leaving enough scope for innovation.

With the help of cloud-based tools, oil & gas operators can analyze all types of data on the fly to accelerate decision-making and deploy transparency in operations. Companies in the oil & gas analytics market are innovating in platforms that enhance field productivity and empower users with real-time feedback on equipment performance.

Data Integration across Oil & Gas Fields Help in Cost Saving

Predictive analytics in the oil & gas industry is found to reduce risk and facilitate fast decision-making. Teradata Corporation-a provider of database and analytics-related software is increasing its portfolio in oil & gas analytics to offer users a holistic view of their data points regarding drilling and completions, production, and refining. Companies in the oil & gas analytics market are increasing their focus in drill bit failure analysis and enterprise analytics applications to eliminate the complexity of enterprise application integration.

Attaining real-time visibility and control over maintenance costs has helped to create incremental opportunities for oil & gas analytics providers. As such, data integration has become increasingly important for end-users, as platforms help to in-sync data from all sources such as rigs, field assets, sensors, and plants.

Other articles and publications:

Mineral Oil & Mineral Spirit Market Competitive Strategies, Growth Factors and Regional Outlook 2030

Mineral Oil & Mineral Spirit Market Competitive Strategies, Growth Factors and Regional Outlook 2030

Articles and publications of other companies:

- +1 (518) 618-1030

- State Tower, 90 State Street, Suite 700, Albany NY - 12207, United States